Your Indirect Tax Compliance in Real Time, at All Times

VAT.com is the one-stop shop for your indirect tax compliance in more than 60 jurisdictions.

VAT.com supports the full cycle of VAT/GST processes: planning, controlling data, and preparing and filing declarations. (compatible with Making Tax Digital)

Designed for multiple companies and users, VAT.com promotes collaboration: review and validate work online, view the audit trail of data modifications, trade flow variations, and much more.

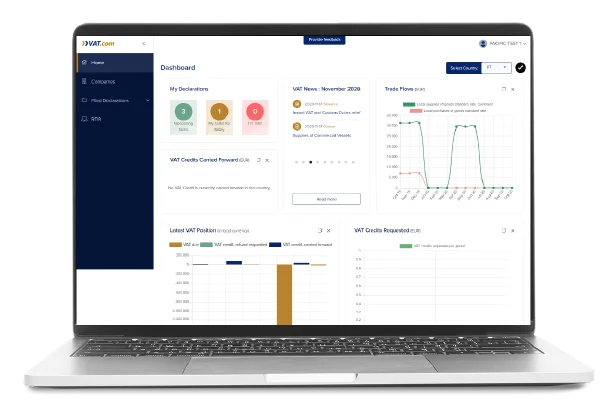

VAT.com Dashboard

The dashboard provides a comprehensive overview of your indirect taxes: upcoming compliance tasks, historic trade flows, tax credits, ongoing projects, ongoing advisory, and VAT news.

Customise your dashboard: Widgets can be moved around and organised as you see fit.

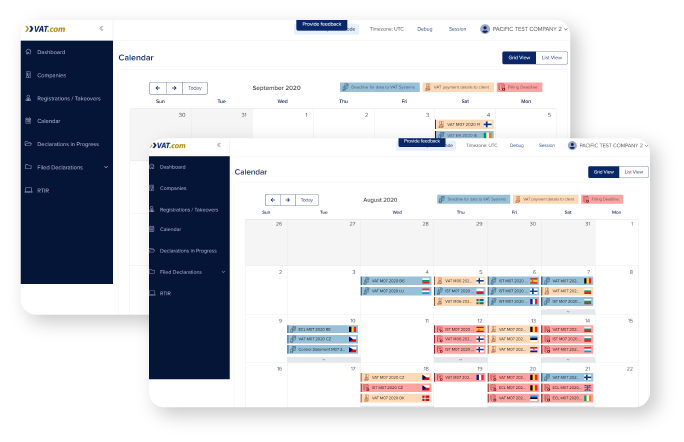

VAT.com Calendar

The calendar guides you to ensure all filing obligations are fulfilled on time.

It displays the upcoming deadlines per country:

● Deadlines to upload your data

● Deadlines to pay your taxes

● Filing deadlines

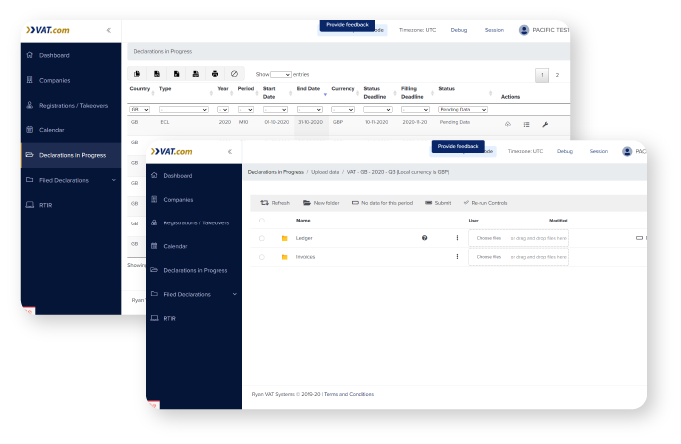

Upload Data

VAT.com sends you an email reminder on the day you should upload your data.

Click on the link in the email and drag and drop your ledgers directly in VAT.com.

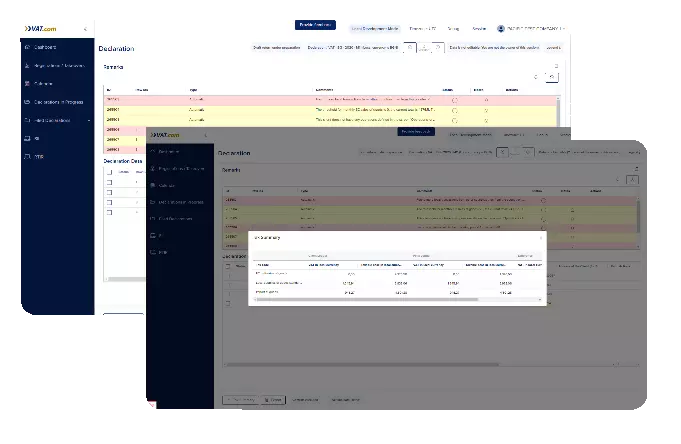

Compliance Controls

VAT.com connects to external databases (VIES, central banks) and runs more than 100 integrity and consistency controls of uploaded data automatically.

Our team reviews the remarks generated by these controls and requests your approval where required.

An email is sent to you with the link to VAT.com to review and edit data online.

The Tax Summary table provides a complete audit trail of data modifications and amounts per tax code.

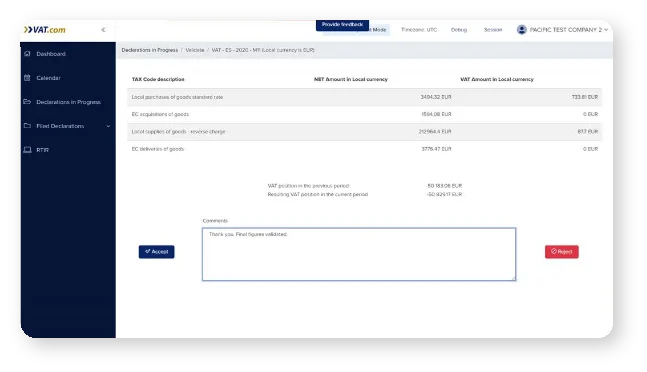

Validate Draft Return

An email is sent to you with your VAT position and payment references and a link to validate the draft declaration in VAT.com.

After validation, filed declarations and the audit trail of data modifications will be available online; you can download or extract in Excel.